Union Bank of India becomes 1st major bank to become signatory of PCAF

PCAF is a global partnership of financial institutions working to develop and implement a harmonised approach to assess and disclose greenhouse gas emissions

Union Bank of India: FY 2024 Mein Mazboot Performance Aur Expansion Ki Planning

Union Bank of India ne FY 2024 mein apne strong performance se investors aur market experts ka dhyaan khinch liya hai. Bank ne apne quarterly results release kiye hain, jisme net profit mein kaafi significant growth dekhne ko mili hai. Saath hi, bank ne digital banking aur customer services mein bhi kai reforms aur expansion plans ka announcement kiya hai.

Recent Financial Performance

FY 2024 ki second quarter mein Union Bank of India ne ₹3601 cr. ka net profit report kiya, jo pichle saal ke same period ke comparison mein 10% se 12% zyada hai. Ye growth primarily NPA (Non-Performing Assets) mein kami, better loan recovery, aur interest income mein growth ke kaaran possible hui hai.

Digital Banking Par Focus

Union Bank ne digital services mein bade reforms kiye hain, taaki customers ko better aur faster services provide ki ja sakein. Bank ne apne mobile app aur internet banking platform ko update kiya hai, jisme naye features add kiye gaye hain jaise instant loan approval, easy fund transfers, aur bill payments. Yeh updates customers ko hassle-free banking experience dene mein madad kar rahe hain.

Expansion Plans

Bank ne agle kuch saalon mein apne branch network ko expand karne ka plan announce kiya hai, khaaskar rural aur semi-urban areas mein. Bank ka focus financial inclusion ko badhawa dene par hai, jisme kisan aur chhote businessmen ko financial support dena shamil hai. Saath hi, bank MSME sector ke liye bhi naye loan schemes laane ka plan kar raha hai, jo local businesses ko boost karega.

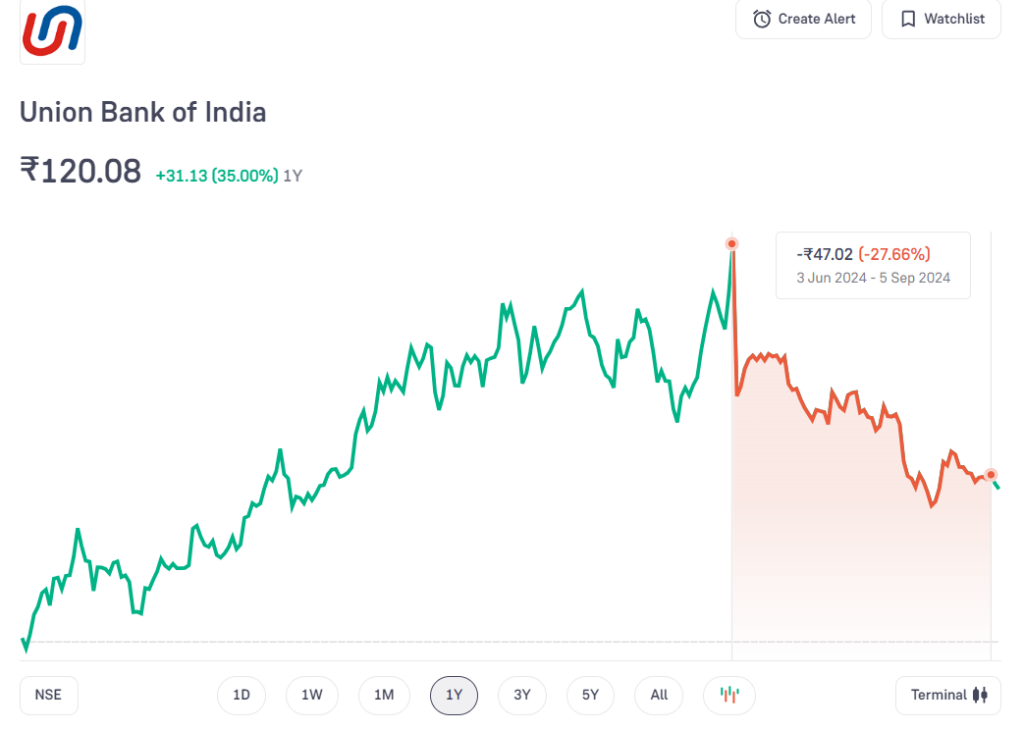

Stock Performance

Stock market mein bhi Union Bank ke shares ne recent times mein achha performance dikhaya hai. Shares mein [percentage] ki rise dekhi gayi hai, jiska reason bank ke improving financials aur growth plans ko mana jaa raha hai. Analysts ka kehna hai ki agle kuch quarters mein bank ka stock aur better perform kar sakta hai, jisme loan book ka expansion aur NPA control key factors honge. stock 52 weeks se 25 to 30 percent down me chal rha hai but ye stock fundamentally strong bataya ja rha hai.

Conclusion

Union Bank of India ne apne operational efficiency ko improve karte hue 2024 mein impressive growth dikhayi hai. Digital banking aur expansion ke through bank apne customer base ko aur expand kar raha hai. Investors aur market experts is bank ko long-term ke liye ek achhe investment option ke roop mein dekh rahe hain.