IRFC Shares: Ek Strong Option for Stable Returns

Indian Railway Finance Corporation (IRFC) ne investors ka kaafi attention grab kiya hai jo market ke volatility ke beech stable aur long-term returns ki talash mein hain. 2021 mein stock exchanges par listing ke baad se IRFC ne consistent performance dikhaya hai, jiska major reason Indian Railways ke saath iska strong connection hai, jo India ki economy ki backbone maana jaata hai.

Recent Performance

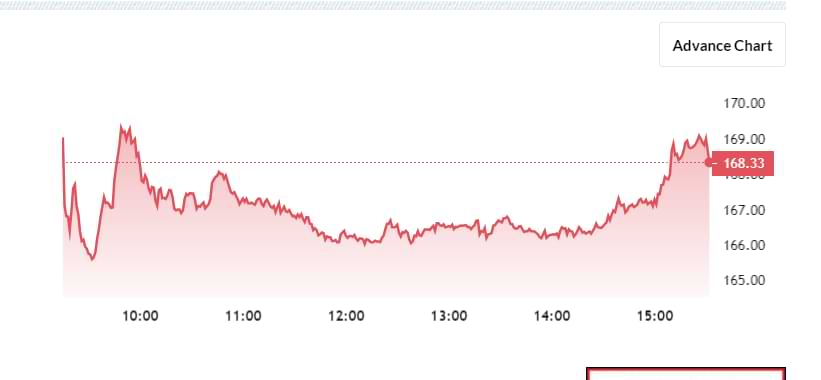

[9/9/2024] tak, IRFC ke shares ₹[168.40] par trade ho rahe hain, jo pichle month mein percentage drop ko reflect karte hain pichle 2 month me ye share karib 20% se jyada gir chuka hai . iss stock ka 52 week high 229.00 RS. dekha gya hai

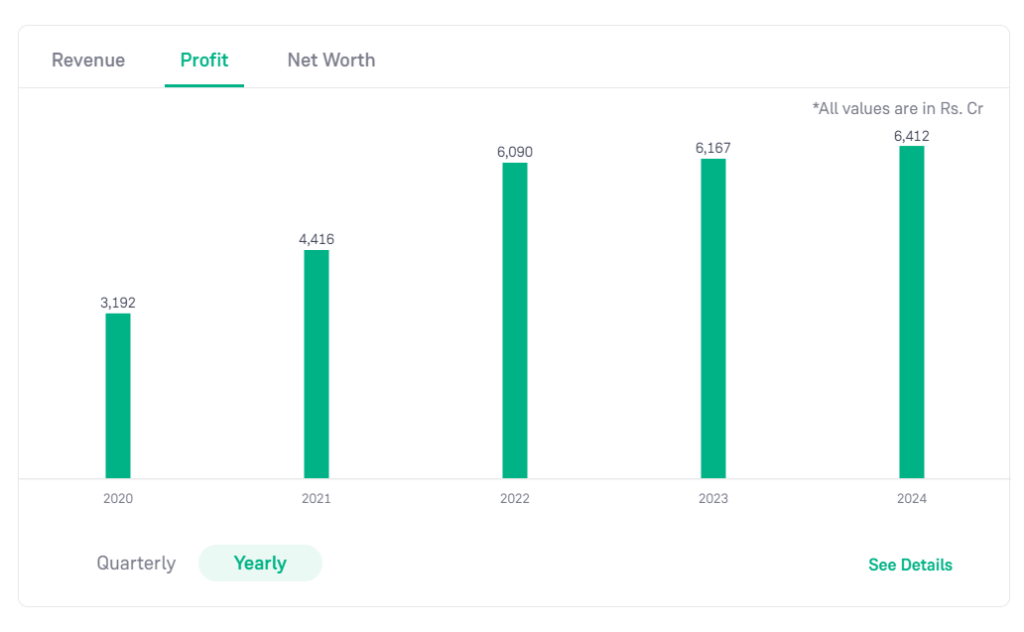

Latest quarter mein, IRFC ne ₹[1577 cr.] ka net profit report kiya . is share ke profit me bhi har saal growth dekha ja sakta hai

Key Growth Drivers

- Government Support: IRFC ek government-owned entity hone ke kaaran financial backing ka special advantage enjoy karta hai. Bharat Sarkar ka continuous focus railways ke modernization aur expansion par hai, jo IRFC ke liye steady business ensure karta hai, making it a low-risk option for investors.

- Consistent Returns: IRFC regular dividends dene ke liye jaana jaata hai, jo income-focused investors ke liye kaafi attractive hai. Indian Railways ke saath long-term lease agreements ke through, company stable cash flow generate karne mein capable hai.

- Railway Network Expansion: Jaise jaise India apne transportation network ko improve kar raha hai, railways uske center mein hai. IRFC rolling stock, station modernization aur high-speed rail projects ko fund karne mein key role play karta hai, jo iske growth ke liye opportunities create karta hai.